Piedmont Federal Savings Bank has always been known for its neighborly, familial approach to business, and nowhere is that more evident than when it comes to dealing with just that – our families.

If you happen to fall between the ages of 40 and 60, you may be feeling a bit of a squeeze in your financial responsibilities. Aptly referred to as the “sandwich” generation, you may be managing your own finances, but possibly those of your aging parents, and your children as well.

“In many cases, this ‘sandwich’ generation is employed full-time, with children ranging in age from middle school to college, or you may have college graduates moving back home,” says Ginger Salt, SVP, and Chief Marketing Officer. The all-too-familiar squeeze comes in when your aging parents are not financially secure, and you face the choice of having parents move in with you, or finding them safe, secure, yet economically feasible living arrangements.

Even if your older parents have a solid financial foundation and are prepared for this next stage of life, this time is still an emotional roller coaster for those adult children – seemingly stuck in the middle.

“There is the pressure of dealing with an aging parent who is going through a big transition – mentally, financially, emotionally, physically, and geographically,” explains Ginger.

When parents relocate from a home or community they’ve lived in for several decades, a variety of transitional tasks can fall on their adult children – who are also still nurturing their own offspring at home. Smoothing the waters – and emotions – for all three generations can be achieved, with some careful, thoughtful, and heartfelt planning.

- Have an open, honest discussion with your parents prior to them needing extra care. Start by assuring them you want to honor and respect their wishes for care and living arrangements. Then, it’s necessary to find out their level of retirement savings, and how those funds are allocated: checking or savings accounts, IRAs, trusts, or other investments.

- Determine if your parents have a long-term health care policy, which is a crucial element of arranging care as their health needs change.

- Discuss being added as a General Power of Attorney and/or Health Care Power of Attorney, to assist with financial, medical, and other matters on their behalf, when the time comes.

- Do your own research by contacting local resources who can provide information on senior care in your area – in a variety of price ranges – including the options of a retirement community, in-home care, or simply modifications in your parents’ current home. Learn about Medicaid eligibility or any applicable military benefits. Contact nonprofits who specialize in assisting the elderly, such as Senior Services, who can help caregivers with services and education that will benefit them.

- Prioritize a list of your parents’ items such as real estate and cars that could impact your parents’ financial resources, and keep this information current if and when a sale becomes your best option.

- Stay active in your aging parents’ day-to-day care and financial decision making, as the elderly are often targeted by criminals and scammers. Know the most current scams, and make your parents aware of them, too. For example, fake sweepstakes emails are a popular way scammers prey on the elderly. You may have also heard of scammers perusing local obituaries, obtaining names of grandchildren, and targeting a widow or widower with the story that their grandchild has been in an accident and needs money wired to them immediately. Social media romance scams and online dating groups can also be risky for the elderly, especially for a recently bereaved parent who is seeking emotional engagement. Remind them on a regular basis not to divulge their personal information or account numbers to anyone over the phone, and suggest they use a fraud or credit monitoring service to keep their accounts safe.

The beauty of a hometown bank like Piedmont Federal is that their employees truly know their customers. Unusual account activity or sudden numerous wire transfers are noticed, and customers are alerted that fraud may be occurring. Piedmont Federal understands the importance of educating customers and families, so their hard-earned savings are protected.

If you’ve now recognized yourself as a member of this “sandwich” generation, go easy on yourself, and understand that juggling more than one household is a challenge. Delegate tasks to other family members as much as you can, and never hesitate to ask for professional help in keeping your parents’ hard-earned savings – and your own sanity – intact. It’s a balancing act, where each age group commits to compromise as needed: more economical accommodations for your parents in order for their savings to last, less costly universities or financial aid for college-age children, and a stronger savings plan for yourself to prepare for your own retirement!

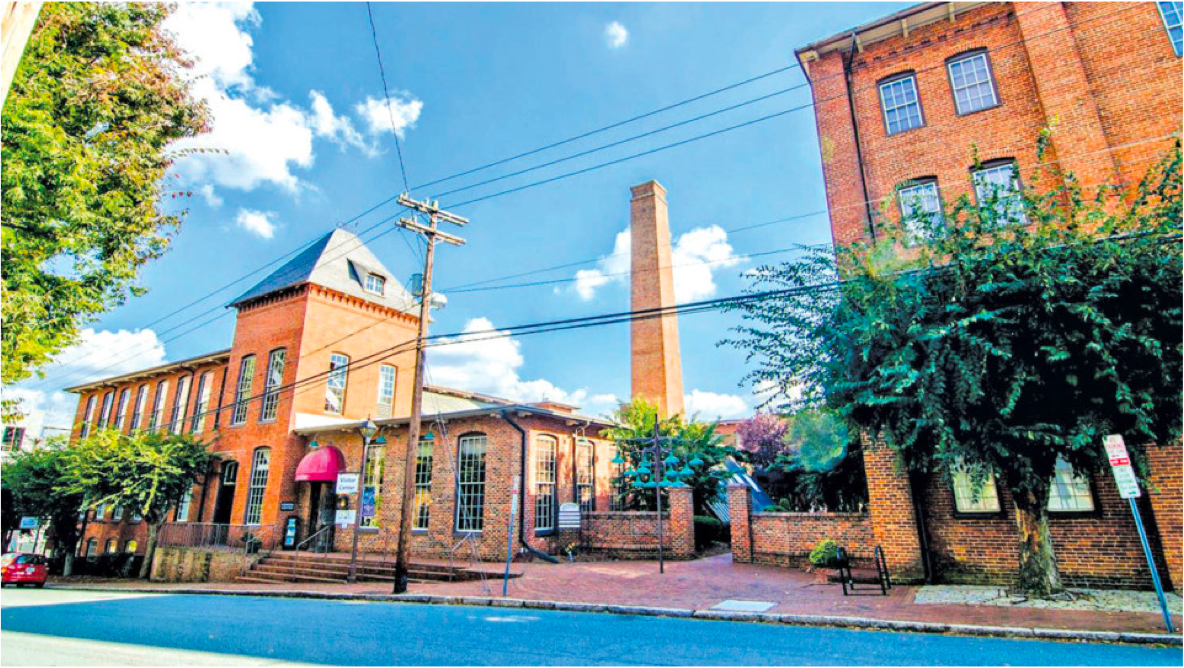

For more information, visit Piedmont Federal Bank at one of their eight locations in Forsyth County, or stop by their North Wilkesboro or Boone branches. You may also contact them at 336-770-1000. Explore their services online at Piedmontfederal.com.