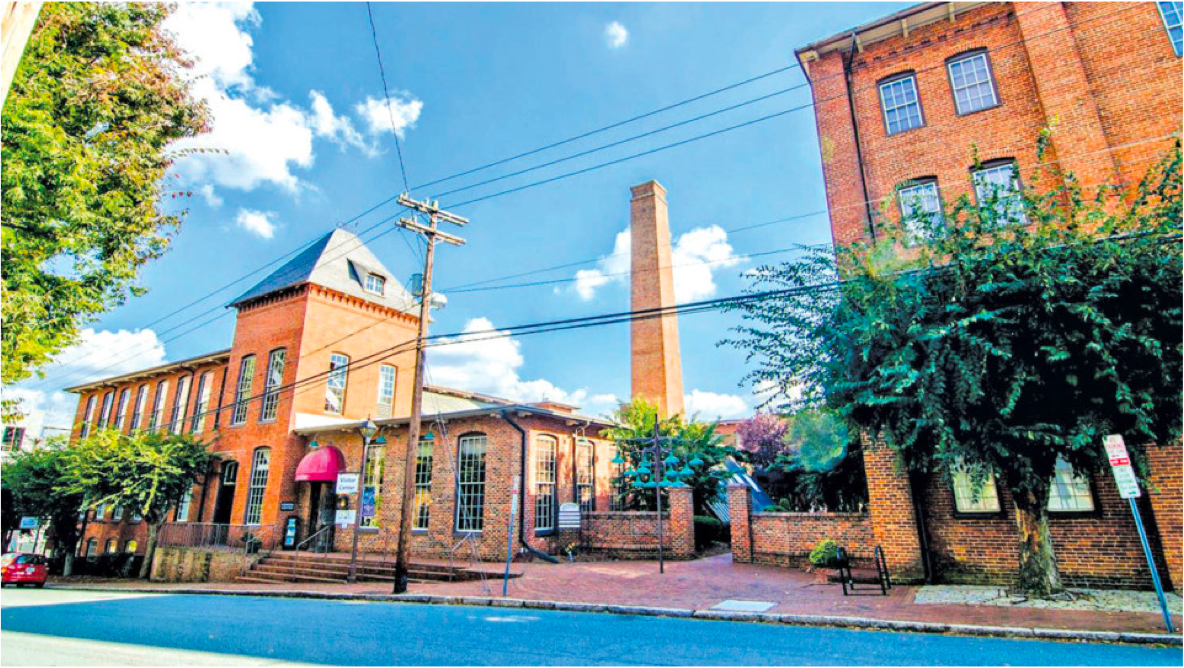

As our business and our clients mature, so do the topics that tend to take center stage in client reviews and discussions. Over the past several years, the topic of health care later in retirement, by way of moving to a retirement community or to some type of care facility, is a more frequent discussion. The fact is that the largest portion of the baby boomer population is now at the age where their demand for enhanced care at facilities will hit its generational peak within the next 10 years. To further compound the problem of availability, there has been a concerted effort to not overbuild new facilities and campuses to meet the current demand because, in 20 or so years, as the baby boomer population is no longer with us, the following generations are much smaller in size. It will not be until the millennial generation reaches the golden age in retirement that we will again see the supply demand issue rear its ugly head.

So, what do you do now? If you are between the ages of 70 and 80, it is time to plan ahead and be prepared. We encourage our clients to identify a few facilities or campuses that they would be comfortable moving to if there was a need due to health concerns. Setting up an appointment to visit locations that you have identified is key. Furthermore, while on that visit, you may want to sign up for the waiting list because it can take years for something to become available. An important takeaway is to start early and not wait until there is an emergency or a need. Making decisions in a rush or during a stressful time can be extremely complicated, not just for the ones who need care but for the family that is undoubtedly part of the plan, as well.

In order to be the most prepared, we would encourage you not to wait and to start thinking now about what a plan would be if there was a healthcare need.

Securities offered through LPL Financial. Member FINRA/SIPC. Marzano Capital Group is another business name of Independent Advisor Alliance, LLC. All investment advice is offered through Independent Advisor Alliance LLC, a registered investment advisor. Independent Advisor Alliance is a separate entity from LPL Financial.